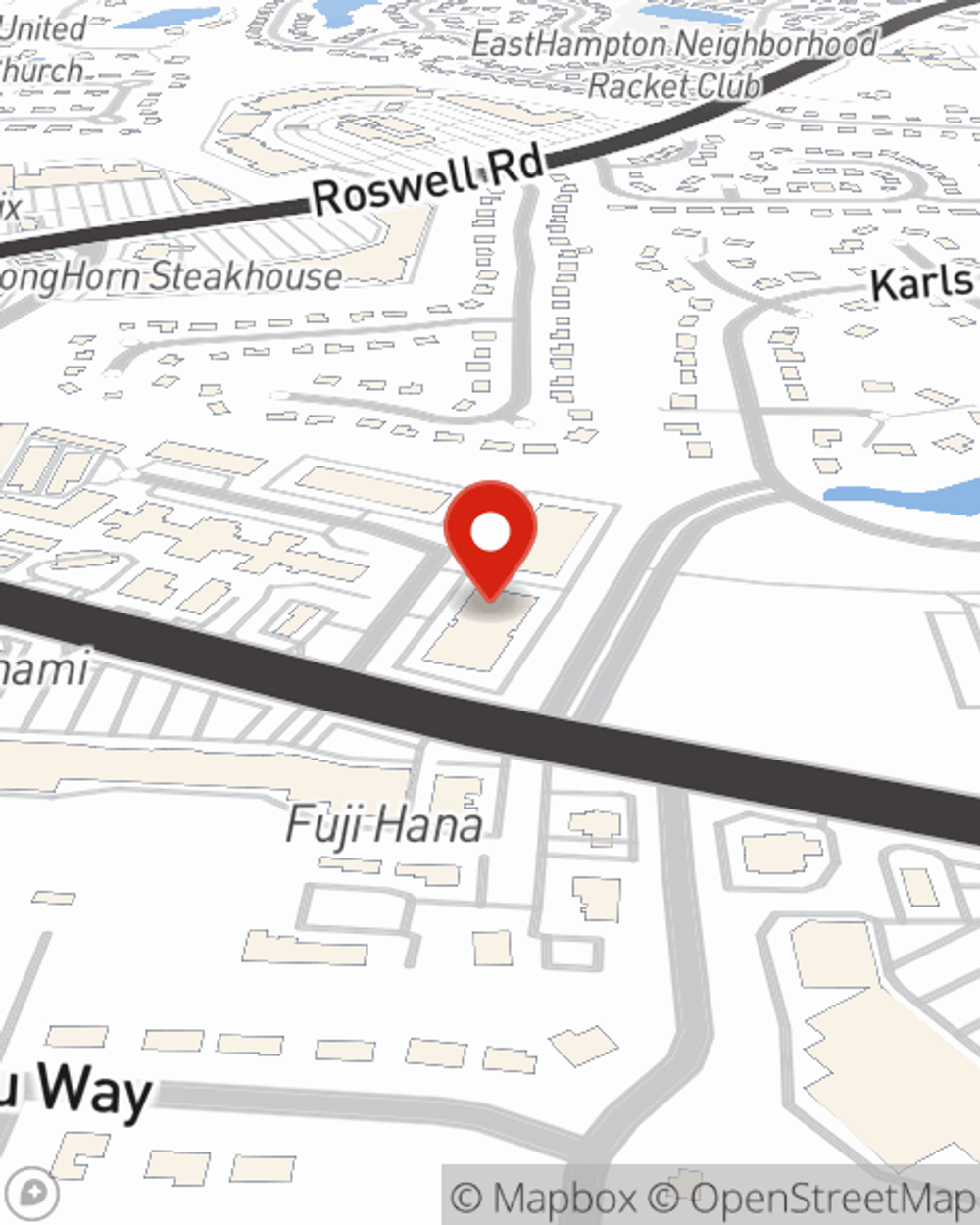

Life Insurance in and around Marietta

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Marietta

- Kennesaw

- Acworth

- Woodstock

- Smyrna

- Roswell

- Atlanta

- Canton

- Sandy Springs

- Mableton

- Alpharetta

- Holly Springs

- Cartersville

- Austell

- Hiram

- Dallas

- Powder Springs

- Brookhaven

- Decatur

Protect Those You Love Most

The average cost of funerals in America is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for those closest to you to meet that need as they face grief and pain. That's where Life insurance with State Farm comes in. Having the right coverage can help those closest to you afford funeral arrangements and not experience financial hardship.

Insurance that helps life's moments move on

Life happens. Don't wait.

Agent Lauren Porter, At Your Service

Fortunately, State Farm offers many coverage options that can be adjusted to align with the needs of your family members and their unique situation. Agent Lauren Porter has the deep commitment and service you're looking for to help you select a policy which can support your loved ones in the wake of loss.

Interested in discovering what State Farm can do for you? Call or email agent Lauren Porter today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Lauren at (678) 373-0030 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Lauren Porter

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.